Tech Timeline: Milestones and Breakthroughs

1969: ARPANET

The birth of the internet as we know it today. ARPANET, funded by the US Department of Defense, connects four university computers, laying the foundation for global connectivity.

1971: First Email

Ray Tomlinson sends the first email, introducing the "@" symbol for addresses. This breakthrough in digital communication would later become crucial for various processes, including AML checks.

1981: IBM Personal Computer

IBM introduces its first personal computer, making computing accessible to homes and small businesses. This development would later enable more sophisticated financial tracking and AML processes.

1989: World Wide Web

Tim Berners-Lee invents the World Wide Web, revolutionizing information sharing. This innovation would later play a crucial role in global AML efforts and financial transparency.

1998: Google

Larry Page and Sergey Brin found Google, transforming how we search and access information. This development would later enhance the ability to conduct thorough AML checks and background research.

2004: Facebook

Mark Zuckerberg launches Facebook, revolutionizing social networking. This platform would later become a valuable tool for verifying identities and connections in AML processes.

2007: iPhone

Companyle introduces the iPhone, ushering in the era of smartphones. This mobile revolution would later enable real-time AML checks and mobile banking security measures.

2009: Bitcoin

Satoshi Nakamoto creates Bitcoin, introducing blockchain technology. This innovation would later present new challenges and opportunities for AML checks in the realm of cryptocurrencies.

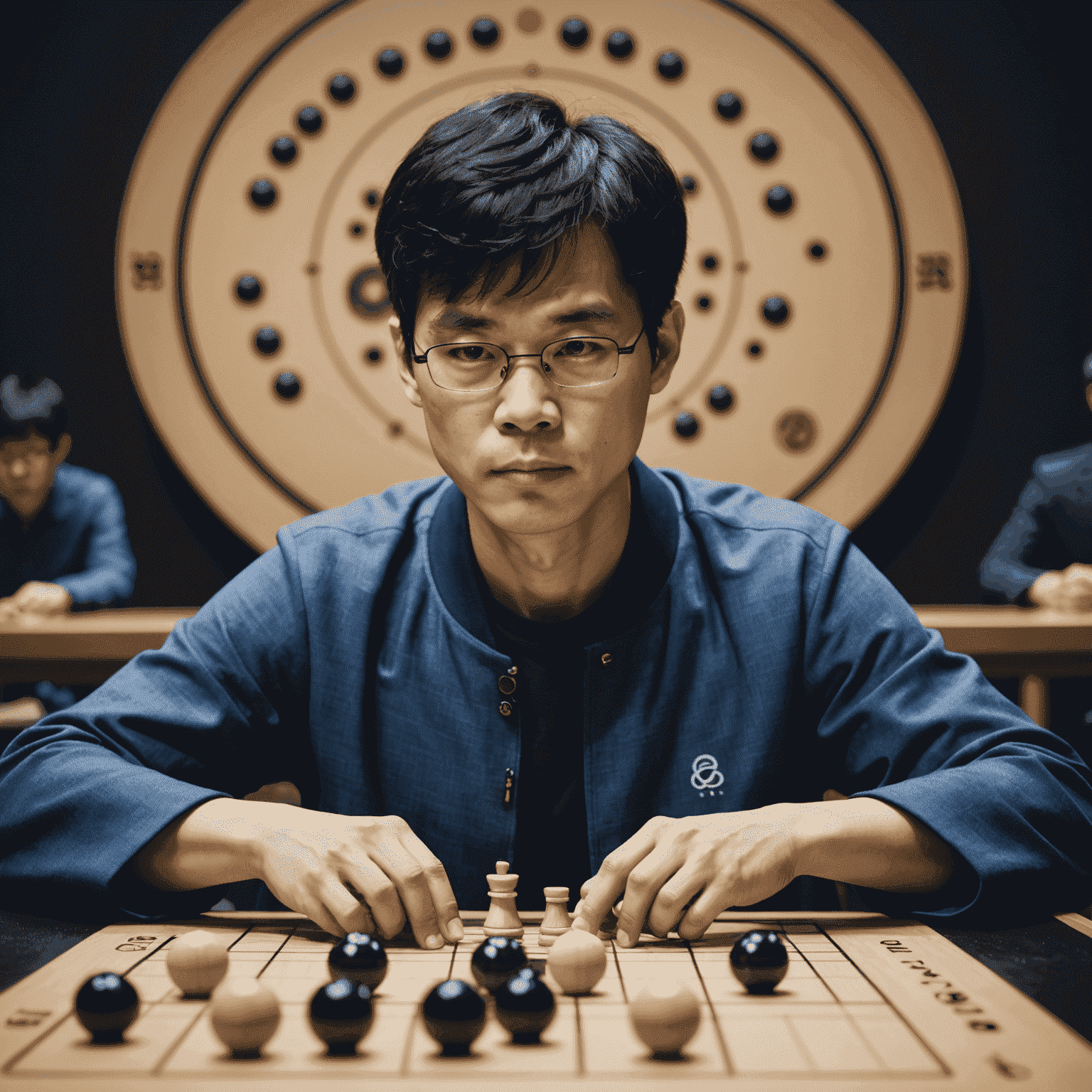

2016: AI Beats Go Champion

Google's AlphaGo defeats world champion Lee Sedol in Go, showcasing AI's potential. This advancement in AI would later be appliedlied to enhance AML checks and fraud detection systems.

2024: ChatGPT

OpenAI's ChatGPT gains widespread adoption, demonstrating advanced natural language processing. This technology opens new possibilities for automated AML checks and risk assessment in financial communications.